Quick Help Guide and FAQs

[Last updated 10/22/2020]

QUICK HELP USER GUIDE

(Click image to open)

FAQs

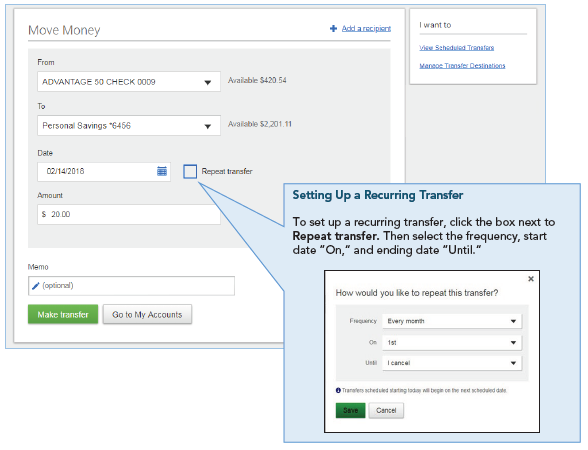

Will I need to setup my scheduled recurring transfers in the new Online Banking system?

Yes. Unfortunately, the scheduled and recurring transfers you setup in the previous NetTeller system will not carry over to the new system. Complete instructions on how to setup scheduled and recurring transfers are found on page 24 of the Quick Help User Guide. Below is a glimpse of those instructions.

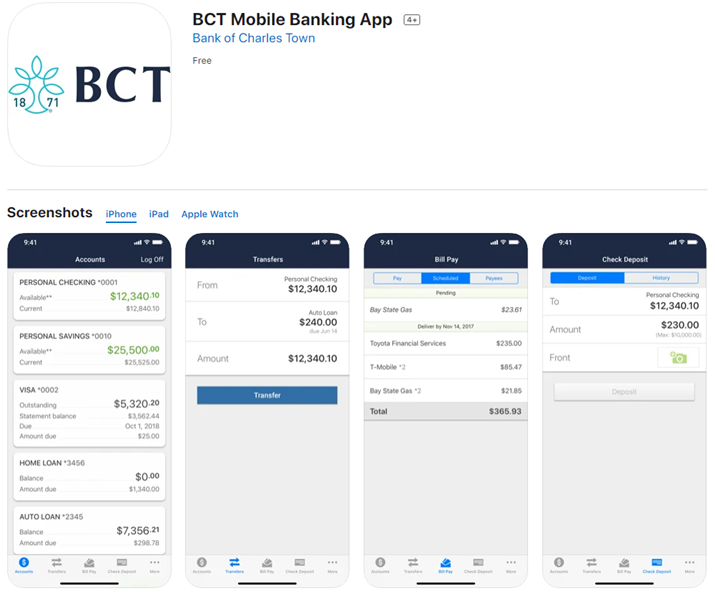

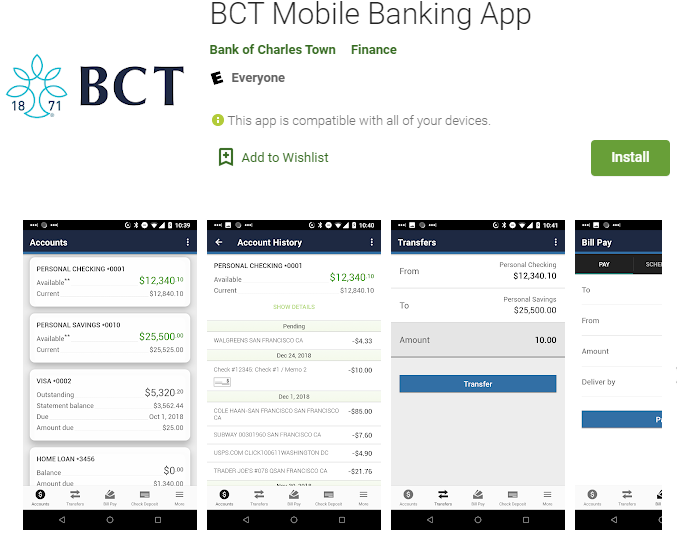

Will I need to update my FBO Mobile App?

Yes. The former mobile app will be disabled on October 19th at 5:00 p.m. You will need to download the new FBO Mobile App from Apple Store or Google Play Store.

FBO Mobile App - Apple Devices

FBO Mobile App - Android Devices

Will I be able to deposit checks using the new Mobile App?

Yes. The process to make a mobile deposit of a check(s) using our FBO Mobile App is almost like taking a picture with your device. Simply select "Deposit Check" in the menu and follow the instructions. Your device must have a camera to make a mobile deposit.

When will funds be available?

Funds are available from mobile deposits the next business day after clearing our approval process. This is a change from the previous mobile deposit process.

Why is the FBO Online and Mobile banking experience changing?

We have been making many improvements as a result of the Customer Experience survey in 2019 and other feedback. We will upgrade to a new Online and Mobile Banking solution to provide a more powerful and personalized customer experience with new innovative features and tools.

What is different about the new Online and Mobile Banking solution?

The new Online and Mobile Banking solution will include several enhancements and new features, including:

- After your initial LOGIN to the new system, there will be no need to update passwords due to enhanced multi-factor security

- Money Management tools to help you set goals, manage budgets and more

- A seamless, personalized banking experience across multiple devices

- A robust mobile app allowing you to deposit checks plus make most transactions found on the desktop version

- Control your FBO Debit Cards by dollar amount, geographic location, and parental limits plus your cards can be turned ON and Off at will (this feature to be added after launch)

- Quicker access to key features, making it easier to find the information and tools you need

When will the upgrade take place?

The new Online and Mobile Banking solution launched October 20, 2020.

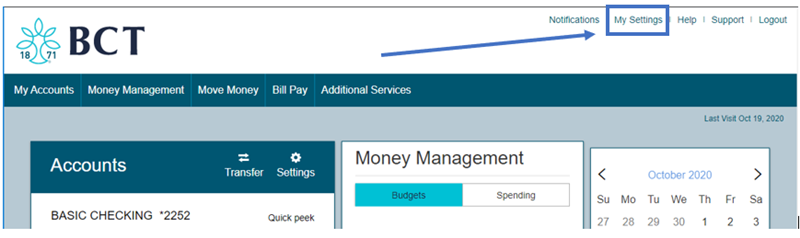

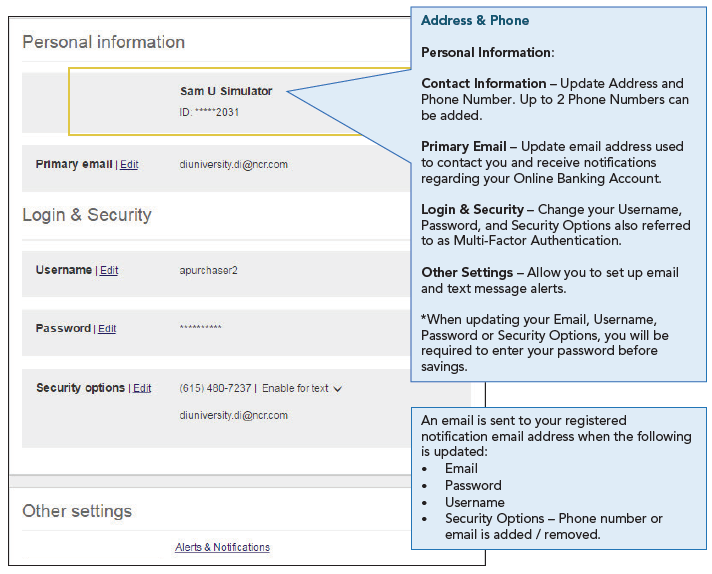

How do I update my email address and other contact information in the new Online Banking system?

1. LOGIN to FBO Online Banking and click the MY SETTINGS link in the top right corner of the homepage.

2. Update information per instructions.

How will I LOGIN the first time to the new Personal Online Banking system?

For first-time LOGIN instructions, see your mailed Quick Help User Guide, or contact your local branch. All LOGINs must occur on FBO's website, or through the new FBO Mobile App.

Will I need to update my Password on a regular basis?

No. One of the enhanced features of our new Online Banking system is the security architecture behind the account information. You will not be required to update your Password, however you may chose to do so at any time by visiting MY SETTINGS and editing your Password there.

What about BillPay? Will I need to make any changes?

Good news. All of your BillPay accounts and payees will transfer seamlessly to the new Online Banking solution. Any scheduled payments setup within your current NetTeller BillPay will continue as usual in the new Personal Online Banking BillPay system.